Sometimes CAS-aligned income streams are also known as Innovative Retirement Income Streams.

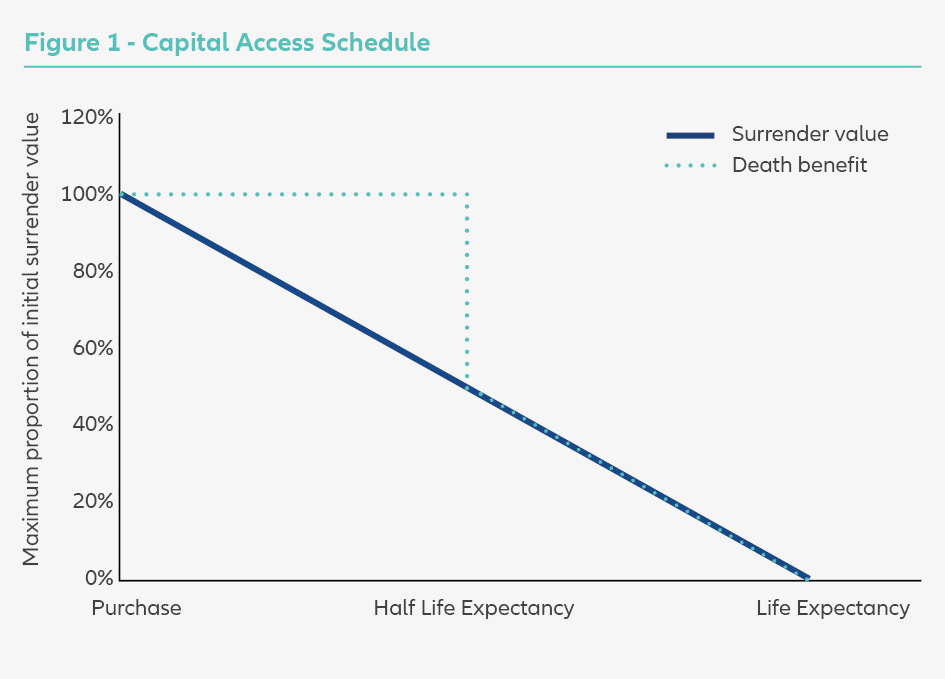

AGILE is a guaranteed lifetime income stream that allows for growth[1] prior to turning on income payments and automatically aligns with the capital access schedule if Age Pension+ option is selected. But not all lifetime income streams that are CAS-aligned will strictly follow this CAS reduction table – some will offer lower or no amounts that may be commuted on withdrawal or death.

Choosing an income stream that aligns with the CAS, such as AGILE with the Age Pension+ option, can be helpful for individuals that would be suited to a lifetime income stream, and who:

- almost qualify for an Age pension, or

- are or will be on a part Age pension but their rate of pension is being or will be impacted by the assets means test.

Purchasing a lifetime income stream that aligns with the CAS can help these clients to qualify for or increase their Age pension entitlement.

There is no requirement to trade-off liquidity in a lifetime income stream

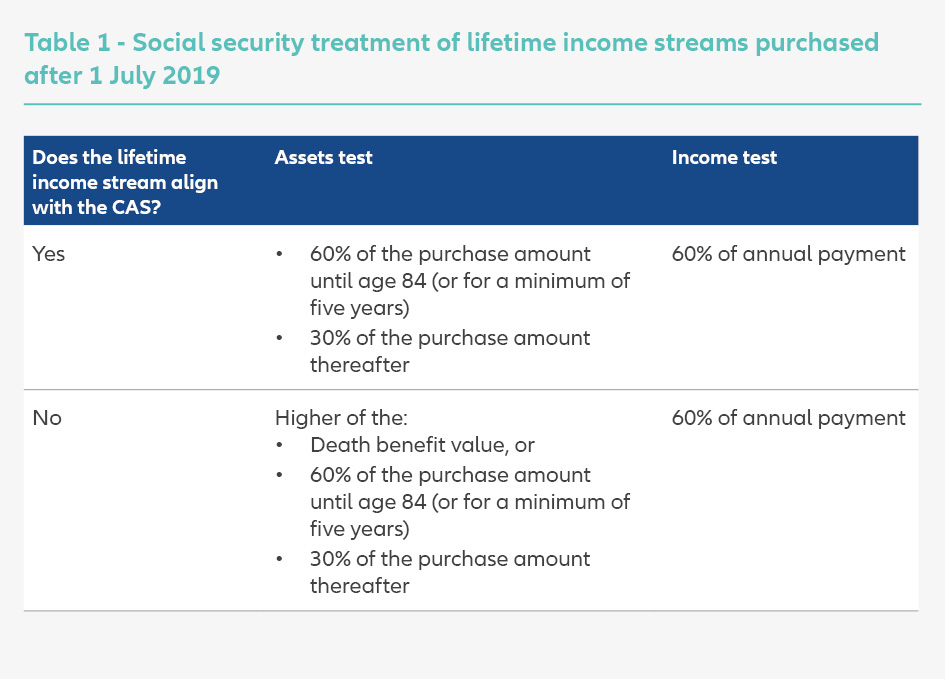

It is not a requirement that lifetime income streams comply with the CAS. There is a significant proportion of retirees that will:

- fully qualify for the Age Pension due to a lower amount of assessable assets

- be impacted by the income means test (rather than assets test,) or

- be self-funded and not looking to qualify for the Age Pension at all.

These clients do not need a reduction in the assets test and can invest in a guaranteed income for life that isn’t aligned with the CAS, such as AGILE. This provides much more flexibility and liquidity if a client needs to access underlying investment value for both withdrawals and death benefits.

With AGILE, when a client invests between ages 50-65, they may be able to defer making the election to have a CAS-aligned lifetime income stream (i.e. defer the choice of whether to select AGILE Age Pension+ option). This decision can be deferred until they either:

- reach a condition of release, for example retirement or reaching age 65, or

- turn on their income.

This means clients can invest earlier for certainty around guaranteed income for life, but make the CAS / Age Pension+ decision closer to actual retirement, when there is more clarity around their assets position for social security

Income test means testing of lifetime income streams

All lifetime income streams purchased since 1 July 2019, including AGILE, receive concessional treatment for the Age Pension Income test. Only 60 percent of income payments from the product are assessable for social security income test. This is true for AGILE whether or not Age Pension+ option is selected.