Summary

- Inflation shock resets rate expectations

- Labour market remains relatively tight

- RBA increases forecasts for 2026 inflation

Summary

RBA alert but not alarmed in face of inflation shock

The Reserve Bank of Australia (RBA) has maintained the cash rate at 3.6 per cent in a unanimous decision as the Q3 CPI release dashed any expectations of a cut. Outside of COVID, this was the highest forecast error since the RBA began targeting inflation in 1993. This latest spike in inflation data dropped the hammer on market participants, who expected easing employment data and benign inflation to support a continued rate cutting cycle. Market expectations have been reset accordingly, with the timing of further cuts now in question for the foreseeable future.

Statement by the Monetary Policy Board

In the Monetary Policy Decision for November, the Board acknowledged that inflation has picked up, and was ‘materially higher than expected’. Headline inflation rose sharply to 3.2 per cent over the year in the September quarter; a large part of which was expected given the cessation of electricity rebates in a number of states.

The Board reiterated its view that rate reductions were supporting the recovery in private demand. However, with labour market conditions still appearing a little tight, the Board decided that it was appropriate to maintain the cash rate at its current level, while not going overboard with a hawkish pivot, expressing confidence that inflation will continue to decline.

Otherwise, the Board noted that the housing market is continuing to strengthen, a sign that recent interest rate reductions are having an effect as prices and construction costs have started to increase again after a period of weak growth.

Our take

Rates were never going to be cut at this meeting. Focus shifted to the tone the RBA would adopt regarding the inflation outlook. Would they see it as an anomaly or a more persistent threat? Unsurprisingly, there was no firm direction given by Governor Bullock who struck a cautious, wait and see tone in the press conference.

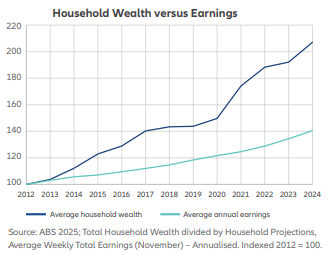

As the RBA approaches a neutral rate, it becomes increasingly difficult to assess whether policy settings are restrictive. Adding to this complexity is the lagging impact of rate cuts as well as the ambiguous but increasingly important ‘wealth effect’ in the Australian economy. Household wealth has continued to outpace wage growth which provides leverage that can amplify the impact of rate cuts larger than previously forecast. Accordingly this should prompt some fundamental questions for the RBA around the efficacy and transmission of monetary policy, and appropriate level of neutral rate. All in an environment where the risks of a policy error are rising.

Despite the Governor’s non-committal tone, the September inflation result has firmly challenged any belief that inflation is tamed and easing in a controlled fashion. Indeed, the Board itself acknowledged forecast inflation will be above its target range of 2 to 3 per cent until the second half of next year. As the Australian economy faces a slowly easing labour market, the Board will begin to walk the tightrope of its dual mandate, while hoping elevated inflation doesn’t show signs of persistence.

Martin Wilkinson

Head of Investments

martin.e.wilkinson@allianz.com.au

Adam Downy

Senior Investment Associate

adam.j.downy@allianz.com.au

Allianz Retire+ is a registered business name of Allianz Australia Life Insurance Limited ABN 27 076 033 782, AFSL 296559. This information contains opinions that are current as at November 2025 unless otherwise specified and is for general information purposes only and is not comprehensive or intended to give financial product advice. Any advice provided in this material does not take into account your objectives, financial situation or needs. No person should rely on the content of this material or act on the basis of anything stated in this material. Allianz Retire+ and its related entities, agents or employees do not accept any liability for any loss arising whether directly or indirectly from any use of this material.