When it comes to planning for and financing retirement, Australians shouldn’t have to worry about tomorrow’s ‘what ifs’ or uncontrollable factors such as inflation or market volatility. They certainly shouldn’t have to fear running out of money. In an imperfect world, risks abound and can have a profound impact on your clients’ retirement outcomes.

The world is undergoing a transition in its financial climate, moving from low-rate, stable inflation conditions to a period of higher rates, an upward spiral in the cost of living and volatility across financial markets.

Retirees have to steer through the immediate market turbulence knowing a wrong move today could have significant implications for their future. There are so many unknowns, so many questions. How long will I live? How much super is enough? What income will I have? What if I need to fix my roof, replace my car, go into aged care?

Many retirees look to ’self-insure’ against such concerns by spending less during retirement – in effect, unnecessarily depriving themselves of a lifestyle they worked hard over many decades to establish and one many look forward to. Given the prevalence of risks that can encumber retirement, it’s no surprise that funding the post-work lifestyle is a cause of stress for Australians in and close to retirement.

Controllable risks

There are some retirement risks that can be described as ‘controllable’; however, that has to come with a caveat. Unforeseen circumstances can capsize the best of plans…just ask the 20 percent of Australians who retired due to ill health or injury, or because of job loss or business closure during 2020-21 [1].

Controllable risks include:

- The timing of retirement – while the average age at retirement of all Australian retirees was 56.3 years, the average age people intend to retire is 65.5 years [2].

- The quantum of retirement savings available – while increasing contributions can mitigate the risk of insufficient savings, competing priorities mean that’s not always possible.

- The rate of withdrawal – the higher the rate of capital drawdown, the faster retirement savings will be consumed.

Uncontrollable risks

Often interrelated thanks to market factors, uncontrollable risks often result in retirees questioning how long their money will last or whether they can afford the lifestyle they want. These risks may have longer term ramifications for both retirement planning and retirement itself: lower investment risk tolerance, increased uncertainty, a reduction in spending or unwanted lifestyle adjustments.

Uncontrollable risks include:

- Longevity risk, or the risk of outliving one’s retirement savings

- Inflation, which chips away at the value of savings and reduces the purchasing power of every dollar saved

- Market volatility, which can erode income producing assets

- Sequencing risk, the risk that the timing of investment returns are not favourable and result in retirees consuming their capital more quickly

- Time, or lack thereof, to make up portfolio losses

- Loss aversion, which can negatively influence investment decision making.

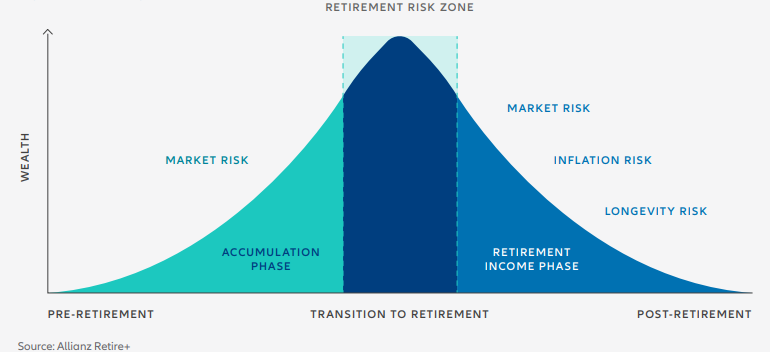

The market conditions that prevail in the years just before and after a person retires can make an enormous difference to the longevity of their funds. Those crucial years are often called ‘the retirement risk zone’ (see figure one), the period when retirees are most vulnerable to market volatility.

If someone is fortunate enough to retire during a bull market, their income drawdowns are generally fully or partially offset by investment returns. However, if the ‘retirement risk zone’ coincides with a period of negative returns, retirees may start eating into their savings at an accelerated rate, potentially emptying the nest egg [3].